*Update 5 Feb 2020- Some credit cards’ cash back policy had changed. But the overall concept of how to earn cash back effectively remains. Will update this post very soon.

Searching for the best credit cards that give you maximum cash back with annual fee waived for life?

Different credit cards serve different purposes, some give you cash back, some give you airport lounge access, and some give you air miles and loyalty points.

With so many options available, it is hard to determine which card suits you best. According to bbazaar.my’s report on local credit card consumer behaviour, cash back benefit is most sought after by fellow Malaysians.

I have done the comparison for all Malaysia credit cards and shortlisted the top 5 best cash back credit cards. Most importantly, I am already using them to get cash back each month. Read further to learn how I earn RM3,036 cash back in the year 2018 (RM253 each month).

Table of Contents

ToggleTechRakyat’s best credit cards in Malaysia:

- Maybank 2 Gold/Platinum Card

- Public Bank Quantum Card

Maybank FC Barcelona Visa Signature(update 10/3/2020- not valid anymore)- Public Bank Visa Signature

- Standard Chartered JustOne Platinum Mastercard

- The Secret Card

Foreword: 4 credit card rules you must know

1. Never simply sign up for any other credit card.

Only apply cards that you need and truly benefits you. Don’t apply for a credit card because the Leng Zai or Leng Lui in the shopping mall promoting to you that there are free gifts, free luggage bags, free coupons, free plush toys or free dash cam.

You should know these freebies are sub-par products. Especially if you need a dash cam, you should buy a decent one and learn more in my best dash cam guide for Malaysians.

2. Never withdraw cash from a credit card.

If you have come to a situation that you desperately need money. Still, don’t withdraw cash using a credit card. Trust me, when you’re in such condition, you’re most likely incapable of paying back the full amount when the due date comes. Instead, you should swallow your pride and ask from your parents, siblings for their help, and commit to paying back them in a timely manner.

Credit card usage can be costly when you do not have the self-discipline and understanding of how credit cards work. You will get into a vicious cycle to pay back your credit card debt.

Most banks charge upwards of 5.00% cash advance fee or a minimum RM20 when you do credit card withdrawal. There is also an average of 18% per annual interest rate from the cash withdrawal date until full settlement.

Taking an example of RM1,000 credit card cash advance and settle within a month (30days):

Cash advance fee, 5% x RM1,000 = RM50

Interest, 18% per annum x (30 days/ 365 days) x RM1000 = RM15

Total true cost = RM65

With only RM1000 withdrawal, you pay extra RM65 equivalent to 6.5% interest in a month time while banks only pay your fixed deposit at roughly 4% interest per year.

Compare 6.5% per month vs 4% per year, you should realize credit card cash withdrawal is convenient yet deadly at the same time.

3. Never spend beyond your means.

Again, credit cards can be deadly when not being utilized wisely. Always track your credit card expenses and never make impulse purchase because you “feel” you can afford. It is a false impression because credit card spending does not reflect immediately in your actual bank account balance.

Self-discipline is the key.

4. Never ever miss a payment deadline.

Many people don’t understand the importance of paying statement balance before payment due date. Credit card companies will impose late payment fees and also may increase the interest rate. The extra money you need to fork out will be tremendous. Worse, it affects your CCRIS score.

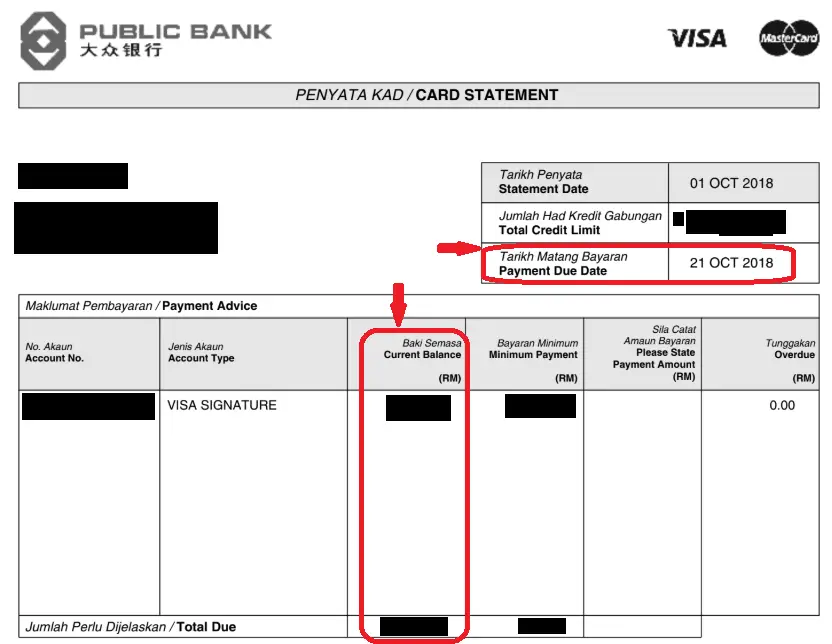

Usually, you can find your payment due date on the credit card statement.

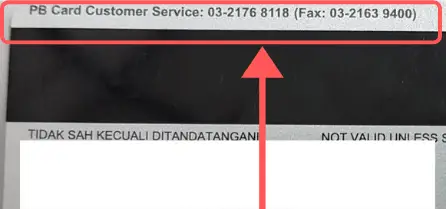

If you are not sure where to check the payment due date, always feel free to call the banks’ customer service for assistance. The contact number usually is available at the back of your credit card.

Then, you can set a reminder on your phone’s calendar or Google calendar so that you will never miss a credit card payment anymore.

How I pick

- Annual fee – Credit card should be free of annual fee or reasonably charged where the cash back can easily cover its cost.

- Minimum income criteria for credit card application – Some cards are great, packing tons of benefits and cash back but only available to the rich and privilege. In this post, I will only cover those with low or average minimum income criteria.

- Cashback categories – Must cover Malaysian top 5 spending categories including groceries, petrol, online transaction, utilities, and mobile. Dining and departmental store cash are not important and they left me puzzle all the times. I can’t imagine one who casually eating out bother to save the 5% cash back.

- Achievable minimum spending/swipe – No minimum spending or swipe for credit card cash back is great but most of the banks/cards require users to reach minimum spending or swipe. It must be relatively easy to achieve. One bad example is Hong Leong’s Wise card which requires minimum spending of RM2,000 on selected categories per month. It is insane given that Malaysians median monthly salaries are only RM 2160. (According to Salaries & Wages survey conducted by Department of Statistics, Malaysia)

No. 1 Maybank 2 Gold/Platinum Cards

Maybank 2 Gold/Platinum is no doubt the best credit card for cash back in Malaysia.

Maybank 2 Gold/Platinum is no doubt the best credit card for cash back in Malaysia.

- -Free for life, $0 annual fee

- -Cash back 5% on weekends

- -Maybank TreatPoints

If you can only apply for one credit card. This one should be on the top priority.

Maybank 2 cards gold/platinum are lifetime free annual free without any condition. As the name suggests, it comes with 2 cards which are Maybank 2 Visa/Master Card and Maybank 2 American Express (AMEX) Card.

All the cashback and TreatPoints can only earn through Maybank 2 AMEX transaction. So, you can keep aside the Visa/Master card.

Maybank AMEX Card gives 5% cash back for all types of expenses on weekends and 5X Maybank TreatsPoints.

- Annual fee: RM0, free for life

- Minimum monthly income: RM2,500

- Cashback limit: RM50

- Cashback categories: 5% for all transaction on Saturday and Sunday (

- Bonus feature: Maybank TreatPoints

Maybank 2 Card Cashback strategy:

Personally, I only fill up petrol by using Maybank 2 Amex card on the weekends and it has become a habit for myself. Thus, I always get 5% cashback and 5x TreatPoints. However, any spending over RM500 on petrol only rewards with 1x TreatPoints.

I would also do my fresh grocery shopping at Tesco on the weekend to get one week load of groceries for my family. Doing so for 4 weeks a month, I easily hit my cash back limit.

In case you still not able to fulfil the RM50 cashback, throw in your Unifi, TNB, Astro or even Maxis, Digi, Celcom postpaid bill, it can easily boost your cash back earning.

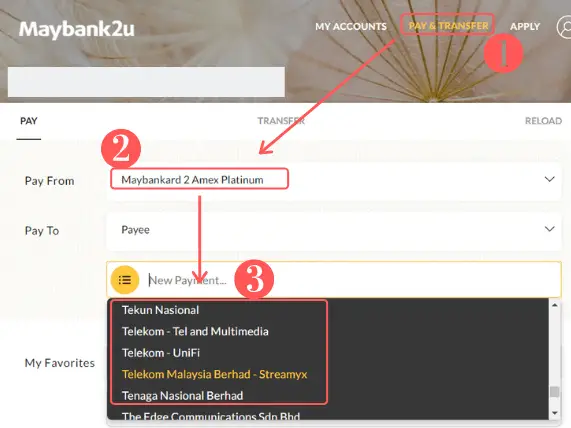

A brief guide is shown as below to pay bills online and still eligible for cash back:

Log in to your maybank2u account > select pay &transfer > select pay from Maybank 2 Amex Card > select from the list of payees.

If you follow all the steps above, I am confident that your Maybank Amex Card cashback will be maxed out at no time.

No. 2 Public Bank Quantum Card

- -Free for life, $0 annual fee

- -5% cash back online transactions and dining

- -FlexiPay for easy installment scheme with no charges

This is a combo credit card where you get both Public Bank (PB) Quantum Visa and Mastercard. It is the second best credit card you should apply right away.

Personally, I find myself use PB Quantum Master Card more often for its 5% cash back on online transactions and dining. Online transactions are easier to achieve as there are so many different spending channels, eg: online shopping, online bill payment etc.

On the other hand, I would not recommend spending on PB Quantum Visa Card which gives cash back on entertainment & departmental store transactions. Good news if you’re a moviegoer because GSC, TGV and MBO app payments are under the entertainment category.

Departmental store transaction can be confusing because not all departmental store spending grant you cash back. I really don’t recommend you to use it if you’re uncertain which store gives cash back.

- Annual fee: RM0, free for life

- Minimum monthly income: RM3,000

- Cashback limit: RM30 per card (RM60 if you can fully utilize the PB Quantum Visa Card)

- Cashback categories: 5% for Online and Dining

- Bonus feature: PB Flexi Pay – An exclusive scheme for any Public Bank credit card users to convert a single transaction to monthly installment. Any spending over RM1,500 can be converted to 6 months easy payment plan (EPP) with 0% upfront interest or management fee.

PB Quantum Mastercard Cashback strategy:

For this credit card, I will focus on using it to pay off various utility bill, like Unifi broadband, mobile phone postpaid, TNB bill and so on. If you have not realized, nowadays most of the utility bills can be paid online.

Public Bank is different from Maybank where the online payment made through pbebank.com is not eligible for cashback. In order to get cash back, you have to make payment through channels below:

- TM Online

- UniFi web portal

- UniFi App

- UOB PayOnline (TNB, TM, DBKL, MBPP, MPSP, MBSA, Celcom)

I easily hit the RM30 cash back limit with a few outside dining in a month.

No. 3 Maybank FC Barcelona Visa Signature Card (update 10/3/2020- not valid anymore)

Maybank FC Barcelona Visa Signature

Maybank FC Barcelona Visa Signature

- -Free for life, $0 annual fee

- -2% cash back for all transaction

- -10% cash back in May and August

Maybank FC Barcelona Visa Signature is one of the rare cards which give cashback for all transaction. There are only a handful of Malaysia credit cards give cash back on all expenses, even if they do, usually it is only 1% or less than 1%.

- Annual fee: RM0, free for life

- Minimum monthly income: RM4,000

- Cashback limit: RM50 per month ( RM100 in May and August)

- Cashback categories: 2% for all transaction and 10% in May and August (football season)

Maybank FC Barcelona Visa Signature Cashback strategy:

This card complements Maybank AMEX card well because not all merchants accept AMEX card. Some only accept Visa and Master Cards. You can use it whenever the merchant doesn’t accept AMEX card.

This card is also great for paying “cukai pintu” and IWL fees.

If you have no dedicated credit card for insurance payment, this card can net you another 2% saving for your insurance fee. Personally, I use OCBC Great Eastern Mastercard to pay my Great Eastern insurance fee.

This card true value is the 10% cash back for up to RM100 in May and August. If you can fully utilize the cards within these 2 months, it already saves you RM200, roughly equivalent to 7 months of PB quantum card’s cash back amount.

No. 4 Public Bank Visa Signature

- -Free for 1st year

- -6% cash back for groceries, dining and online transaction

- -PB Flexi Pay

Public Bank Visa Signature used to be a great card with RM50 cash back each month before they reduced the cashback cap.

I ranked it at no.4 because of its high minimum income requirement and low cash back limit. Regardless, this card is still worth to be kept under your credit card arsenal if you qualify for the application.

- Annual fee: Free for the first year and waived when you swipe 12 times each year. (1 month 1 time, not so bad, right?)

- Minimum annual income: RM80,000 (RM6,700 monthly income)

- Cashback limit: RM38 per month

- Cashback categories: 6% for groceries, dining and online purchases

- Bonus feature: PB Flexi Pay, 2x complimentary Plaza Premium Lounge access in Malaysia per year

PB Visa Signature Cashback Strategy

I would shop online for my daily necessities with PB Visa Signature Card. One of my main monthly expenses is my 1-year-old baby formula and diaper, I will purchase them through Lazada or Shopee to take advantage of the 6% online cash back.

Similarly, you can plan and purchase all your daily necessities or dry goods through all these online marketplaces. It is often that online purchase is a better bargain compared to buy at retail stores.

No.5 Standard Chartered JustOne Platinum Mastercard

Standard Chartered JOP Mastercard

Standard Chartered JOP Mastercard

- -Free for 1st year

- -RM85 max cash back for online purchases

Last on my best credit cards list is Standard Chartered JustOne Platinum(JOP) Cards. You should only get this card if you already maxed out the cash back for above 4 cards.

There are 2 cashback credit cards available at Standard Chartered Bank namely JOP Master Card and Liverpool FC Cashback Credit Card. Unfortunately, both of them come with a steep annual fee.

Liverpool FC card only gives RM50 monthly cashback with non-waivable principal card fee RM175 per year. Thus, the actual cashback earned after deducting the annual fee is only RM35.50 each month.

I pick JOP Mastercard over Liverpool FC card because the cash back cap is higher and the annual fee can be waived with conditions.

Check out JOP Mastercard features as below:

- Annual fee: Free for the first year, subsequently RM250 per year (waived with minimum RM20,000 spending per year)

- Minimum monthly income: RM2,000

- Cashback limit: RM85 per month (depends on spending tier)

- Cashback categories: Tier basis as below, 0.2% – 15% online purchases and petrol

- Bonus feature: Nil

|

RETAIL SPEND PER MONTH (RM)

|

AUTO BILL PAYMENTS, ONLINE PURCHASES AND PETROL

|

OTHER CATEGORIES

|

CASHBACK CAP (RM)

|

|---|---|---|---|

| Below 1,000 | 0.2% | 0.2% | 12 |

| 1,000 – 1,499.99 | 5% | 0.2% | 12 |

| 1,500 – 2,499.99 | 10% | 0.2% | 28 |

| 2,500 and above | 15% | 0.2% | 85 |

SC JustOne Platinum Cashback Strategy:

Being quite a heavy online spender myself, this card used to be my backup card in case there is a spike of spending in certain months. Today I constantly get RM85 cash back each and every month with only one simple strategy.

Let’s find out the details below.

The secret sauce: BigPay Mastercard

- -Free until further notice

- -Free BigPoint when spending and reload

- -Good for credit card consolidation

- -Use referral code 9IS7YVOE6J for free RM10

BigPay Mastercard is practically a prepaid card which comes with e-wallet feature. You have to reload the card before you can start using it.

Annual fee: Free until further notice and no SST RM25 as it is a prepaid card

Key benefits:

- can be reloaded up to RM10,000 per month using a credit card, debit card, or direct bank transfer.

- link to BigPoints account and earn BigPoints with your spending and reload.

- AirAsia flight credit card processing fees (RM8-RM12) waived if using BigPay to check out.

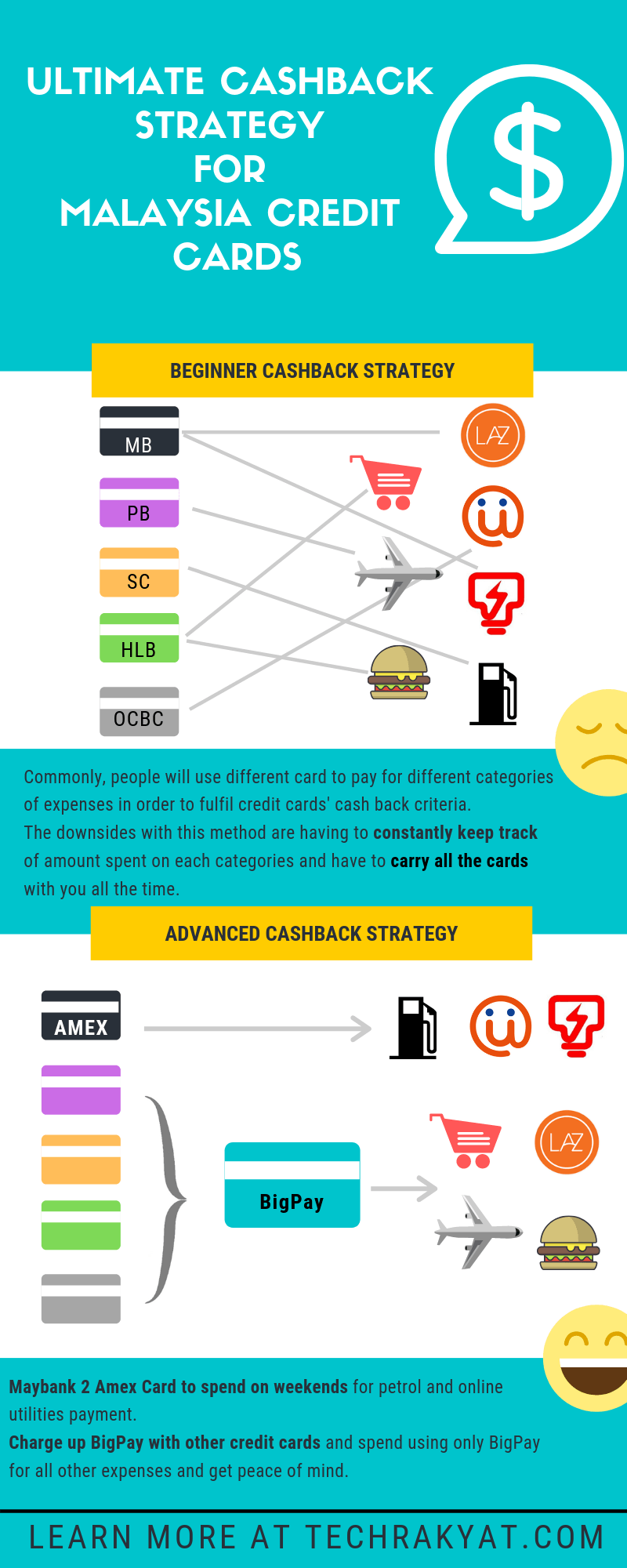

If you ever wonder how all these people achieve their maximum credit card cash back every month? Are they some kind of big spenders or small business owners who simply use credit cards to pay for everything?

Today I will show you the easiest way for an average consumer to get full monthly cash back with BigPay Mastercard as depicted below.

How to apply for BigPay Mastercard:

- Download the BigPay ios app or BigPay Android app

- Open the app and proceed for sign up

- Key in my referral code 9IS7YVOE6J (so both of us get additional free RM10 credit)

- Key in a valid mobile number and real personal details

- Snapshot of your I/C for identity verification

- Top up RM20 to get your card.

My real life scenario on monthly compulsory expenses:

| No | Expenses | Amount (RM) |

| 1 | Petrol for 2 cars (mine & my wife’s) | $600.00 |

| 2 | Groceries | $320.00 |

| 3 | Unifi bill | $147.34 |

| 4 | Unifi bill (parents’) | $147.34 |

| 5 | TNB bill | $150.00 |

| 6 | TNB bill (parents’) | $130.00 |

| 8 | Baby diaper and baby formula | $600.00 |

| Total | $2,094.68 |

As a typical Asian, it is common that we give our parents a monthly allowance. On top of that, you can see I help to pay for my parents’ house Unifi and TNB bill to maximize the credit cards cashback benefit. My parents also appreciate it that I take over one big troublesome monthly chore from them. They no longer need to waste time to queue for paying bills at Pos, TNB or TM Branches.

Combining my monthly compulsory expenses with some dining in restaurants and departmental store purchase like clothes, I would reach somewhere between RM2,500-RM3,000 each month. However, it is still far to get full cashback from all 5 cards.

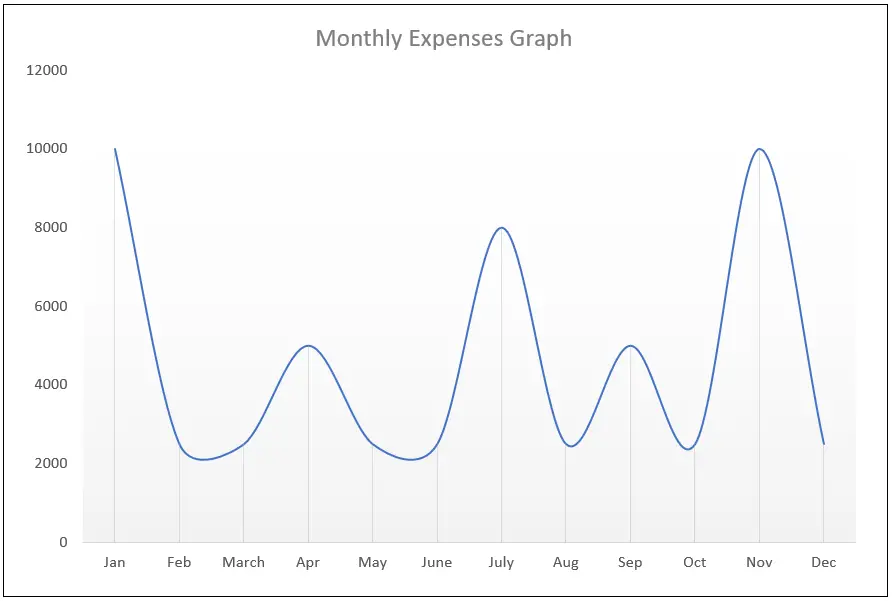

Let’s dive deeper and check out a projected monthly expenses graph:

Normally we tend to spend more during the festive seasons to purchase new clothes, gifts, house decoratives and so on. It resulted in a few spending spikes throughout the year. In such cases, BigPay Mastercard comes into our cashback strategy during low seasons.

Example:

- It is predicted that there will be a lot of purchases made in November Black Friday and Cyber Monday Sales.

- In October, we can charge a portion of the unused credit from the other credit cards into BigPay so that we can earn cash back in October. Yes, transactions to BigPay are eligible for cash back.

- In November, we can use BigPay to make payment for all the new purchases whether online or offline.

- What to do if you charge too much into BigPay and can’t finish the credit in BigPay? There is a safe exit mechanism!

- Unlike expensive cash advance with a normal credit card, you can do cash withdrawal with BigPay Mastercard at any local bank ATM with only RM6 charges per withdrawal. If you withdraw RM1500 each time, RM6 is only 0.4% of RM1500 which is a lower rate compared to the cash back you earn.

- Now you can use the cash on hand to pay for the credit card bills.

With this concept in mind, you can use all the above credit cards except Maybank 2 Amex Card (BigPay does not accept reload using Amex card at the moment) to reload into BigPay to obtain maximum cash back for all the cards.

Then, you can do cash withdrawal at any bank ATM and retrieve all the money back to your saving account.

Make sure to clear all credit card statement balance before payment due date and never spend beyond your means.

That’s my one simple trick to get maximum credit card rebates up to RM3,036 (RM253 per month) in 2018 and tons of loyalty/reward points.

| Credit Card | Cashback/Month (RM) |

| MBB 2 Gold/Platinum | $50.00 |

| PB Quantum | $30.00 |

| MBB FC Barcelona Visa Signature | $50.00 |

| PB Visa Signature | $38.00 |

| SC JOP Platinum Mastercard | $85.00 |

| Total credit card cash back | $253.00 |

p/s: I also won a lot of extra cash back from occasional special cash back campaign from my top 5 best credit cards as recommended.

*** One more extra tip if you are interested in using e-wallet, you can actually charge to Boost e-wallet by using BigPay. Click here to learn more about e-wallet.

Last words:

Use credit cards responsibly and wisely to save money, not to bring more debt to yourselves. If you’re interested in saving money, may be is is time to review your mobile prepaid plan and broadband plan. These two utilities bill do add up quickly.

Comments below if you have better cash back tips and share this post if you think it helps you.

Wish to ask .izit standard chartered just one platinum still get Cashback with big pay top up

hi, since effective 1 June 2019, 5% Cash Back will not be awarded for spend on government bodies and utilities including TNB & Air Selangor using Maybank 2 American Express Card and effective 8 July 2019, any reloads performed on e-Wallets using Maybank Cards will no longer be eligible for Cash Back. What is the strategy to maximize rewards or cashback when paying utilities? Thank you.

Hi i wish to ask about maybank 2 card ezypay and ezycash.

Izit good to apply?

To me, it’s not good… They are 0% installment indeed.

But both ezypay and ezycash have a one-time service fee.

There are better option out there, like public bank flexi pay for 8 months installment at 0.5% upfront.

Ezycash is not advisable to take unless you know what you’re going to do with the money.

Stay around and bookmark this site. I am going to come up with more useful tips for saving money and make money during this difficult MCO period.

Cheers~

Hi. I want to ask about credit card maybank FC BARCELONA.

Maybank has announced that using maybank credit card top up into e-wallet won’t have any cashback.

Izit include maybank FC Barcelona oso??

If i use

maybank FC Barcelona > bigpay > boost > favepay

Do it still work???

Hi,

Sorry for late respond. For all Maybank card, bigpay top up no longer eligible for cashback.

Hi kai, just wanna ask is Maybank FC Barcelona Visa Signature Card still eligible for the cashback when topup to BigPay? And I planning to get both Maybank FC Barcelona Visa Signature Card & Maybank 2 Platinum Card, do you recommend me to apply both together at the same time or apply Maybank 2 Platinum Card first and wait for few months?

Hi,

Sorry for late respond. For all Maybank card, bigpay top up no longer eligible for cashback.

Hi. I want to ask more about how credit card link to bigpay and link to boost.

Izit when U wan to pay something with credit card, u top up those certain credit card into bigpay, then bigpay top up into boost then use boost to pay?

Yes, use credit card to top up in bigpay.

and then use bigpay to top up to Boost

Seems public bank credit card unable top up for BigPay. I facing 3D Secure Payment issue. After i keyed cr card nbr, exp dt and ccv, received sms OTP, page redirect me to bank web page, instead of page to key OTP. Tried many times, cannot top up with public bank credit card. Any idea to solve this?

which public bank card you used ? i just reloaded last week, not encounter any problem.

Public Bank Quantum Master card.

I called BigPay, then u know always asked to uninstall n reinstall the App. Still cannot then asked me call card issuing bk. I called, 1st telebanker said server down n told me to tried few hpurs later. Still cannot. 2nd telebanker said my phone setting problem. I never change my phone setting.

Then i tried my PBB Quantum Master for Boost top up. Cannot too. Others banks, MBB n CTB no problem.

I can use PBB for Shopee, its fine.

I felf PBB block e-wallet top up.

I try top up see if u can top up with PBB card?

I just tried my PBB Visa Signature to reload. Its working fine.

I cant top up even with new replacement cards. Contacting isdue bk to further check

Hi Kai,

I’ve just activated my BigPay prepaid card several minutes ago and got the RM10 bonus. Hope you got the RM10 bonus as well!

Cheers. Looking forward to more articles from you.

Thanks for the support.

How about OCBC Titanium card online transaction ? It is saying uncapped, online transaction…

How about the YOLO card?

How about YOLO card from UOB? https://ringgitplus.com/en/credit-card/UOB-YOLO-Visa.html

I am not sure if this is applicable for the Bigpay?

2. Subject to Clause 16, the Online Spend shall include all online transactions with the Card.

16. The Cash Back under this Programme shall not be awarded for the following transactions:

a) Balance Transfer;

b) Cash Advance;

c) Flexi-Credit Plans;

d) Credit Shield;

e) Easi-Payment Plan purchases;

f) Refunded, disputed, unauthorized or fraudulent retail transactions;

g) Government transactions:

i. Alimony and child support;

ii. Fines by Court, government, state authorities or local authorities;

iii. Bail or bond payments;

iv. Payment of taxes to government; and

v. Payment to any government departments.

h) Alimony and child support;

i) Financial services transactions;

j) Charity bodies;

k) Petrol transactions;

l) Cash and cash-based transactions;

m) Payment of annual card membership fees, interest payments, late payment fees, charges for

cash withdrawals, goods and services tax and any other form of service/miscellaneous fees

using the Card;

n) Transactions made to Grab; and

o) Such other transactions as UOBM may determine from time to time.

Maybank 2 Gold AMEX card if spend over the weekend, to charge to the Bigpay max 1000, would I be able to get the max cash back of RM50?

You can’t top up BigPay with Amex

Hi Kai! I found out this CC – CItibank SImplicity it seems like a good card with 10% cashback (applied on all transaction) without cap or minimum spending, do you recommend it?

hi kai

how to use big pay made payment for DBKL?

Hi Kai, thanks for such a fascinating article. May I ask, charge up Bigpay is considered online or e-wallet payment. In which case, many cards do not give cash back for e-wallet topup. Such is the case for maybank:

https://ringgitplus.com/en/blog/Credit-Card-News/No-More-Cashback-And-Rewards-Points-For-E-Wallet-Reloads-For-Maybank-Cardholders.html

All of the cards I recommended above except for Amex are used to be eligible for cash back when top up to BigPay.

However, recently most of the bank already revise their policy. But this method still works for public bank card.

Hi Kai, may I know as below question:

1. if I use the PBB signature visa credit card to top up bigpay card, is it I can earn 6% cash back?

2. Is it I can use bigpay card to repayment another credit card? Meaning If I have $500 UOB credit payments need to settle, is it I can use bigpay card to settle UOB card payment? Thanks.

3.which card to top up bigpay card can be earn cash back?

Many Thanks.

1. Yes

2. No credit card could work that way. No bank allows you to do so. You can only withdraw cash from BigPay account to pay for another credit card.

I don’t recommend you to do so because when you fail to manage it properly, you will fall into an endless debt spiral. DON’T EVER DO THAT.

3. Public bank cards are still eligible.

You’re welcome

Hi kai. Since Maybanka nd StanChart has released their statement revising their cashback policy, will you revisit this guide any time soon?

The shortlist that i have now are:-

Public Bank Visa Signature

PB Quantum Credit Cards

AmBank TRUE VISA Credit Card

RHB Signature Credit Card

RHB World MasterCard Credit Card

RHB Islamic World Mastercard Credit Card-i

Will revise the article when I find the time to do so… Too busy at the moment

Hi Kai, as the Maybank AMEX card no longer applicable for utilities payment, do you have any updates in your strategy?

Hi, Kai! In order to get those free gift of applying a new credit card(PB Quantuam master & Visa card), it requires certain amount of retail transaction. Is it consider “retail transaction” for reload the bigpay card?

Yes.

MBB AMEX and FC Barcelona has revised benefits. You may wanna update your post Kai. 🙂

Noted. Will update it soon.

Hi, just to update, start from 1st June 2019 Maybank 2 gold/platinum and barcelona card is not eligible for cash back on utilities 🙁 some more no 5x points on weekend for using Amex. too bad. any other good credit card recommendation?

Thank you

Noted it too. Will update my post soon

Barcelona card can still get cash back for BP rite?

Yes

can cut amex 2 card already and replace to Maybank visa signature for 5% monthly cap 88 of petrol and groceries. uob yolo visa is good for online transaction to get rm50 rebate.

Bro, thanks for your tips…. Really can see you have put alot affort on this…..

Hi,

The JOP platinum mc still can get rm85 cashback after top up bigpay rm2500?

Is PB Quantum Visa Card entitle cashback when you top up to BigPay?

Or only PB Quantum Mastercard Card can get the cashback by top up to BigPay

Only The Mastercard 🙂

Hi, great post! I have been using this cards and recently thought of using big pay to reduce the cards in my wallet. the last card i got was SC Just one. great minds think alike i guess. hehe. Anyways Im wondering why dont you have HLB wise in your list. That was one of my first CCs. 10% on groceries, fuel and phone bill for myslef. The only downside in you have to spend RM 2k every month. But again BIG pay comes in handy.

hey Kai,

Stumbled upon your site when trying to research on saving money. thank you for the wonderful information.

1 question, how does the credit cards/banks give the cash back? Is it just by minus from the monthly bill or banked into a bank of choice?

Thank you!

Hi Kai, i heard some of my friends who are using PB Quantum Mastercard, they didn’t receive any cashback when they topup Bigpay, is it true??

Hi Conn,

It’s still working. Not sure why your friends face such a problem.

Join the discussion…

I read the TnC for Maybank FC Barcelona Visa Signature. The cashback is only given for retail transactions. So is reloading into BigPay considered as retail transaction and eligible for cashback?

Yes. It is entitled to cash back by reloading to BigPay. If you keen to apply any of the cards above, please use my links above.

I earn a small fee from there which keeps this site afloat. Thanks

Hi Kai, I dont see BigPay offering any cashback but points. Am i missing out on something here? I currently got BigPay and i have yet to activate it.

I am also looking for a credit card for:-

1. My privellage savings account gives me higher interest rate if i link my credit card and insurance payment to it.

2. Cashback – contemplating between the Maybank Barcelona or Stand Chart Just One.

Whats your verdict on getting the maximum cashback?

BigPay does not offer any cashback.

It is an additional card for you to reap the cashback from the 4 credit cards I have recommended. I have explained quite detailly.

You may want to re-read my guide above.

Question no.1 – I don’t quite get the question. Can you re-phrase it?

Question no.2 – Put the maximum cashback cap aside. Barcelona is ranked no.3 in my list. I will always advise one to get Barcelona first rather than JOP card. JOP card required RM250 annual fee and high amount of spending per month. It is not that friendly for small spender.

to date, are all these credit card mentioned in the article except for amex, is entitled for the cashback for topping up bigpay?

Yes, exactly.

what about Alliance Bank You:nique – Great Rebates?

will i get 3% capped at rm90 for topping up to bigpay?

Hi kai, i have a question for u. i often travels for work..here is my situation: Let say I travel in January, I claim February get the claim on March.. so there will always overdue payment in my credit card since I also travel in February and March..usually claim get 2months after that. U have any suggestions which credit card good for me? I think I want to change my recent credit card cz currently I’m using cimb..the annual fee around 50+. Every months there will be 5-8k overdue payment waiting for my company to release the payment and always been charge 100+ for my overdue payment. Hope u have good suggestions for my situation thanks.

I suggest you get another credit card & topup it using bigpay, withdraw the money in big pay to pay for your first cc. This way you can save the interest. Make sure to get your second cc statement date few days before 1st cc payment date. So you can buy more time. Repeat until the company reimburse your expenses

Hi, Kai! In order to get those free gift of applying a new credit card, it requires certain amount of retail transaction. Is it consider “retail transaction” for reload the bigpay card?

Hi, I need to know exactly which credit card are you referring to, then only I can advise.

Thank for for your summary of the best cash back credit cards. Its very helpful.

The strategy of using Bigpay is very creative and good too.

You’re welcome. Bookmark teckrakyat.com and share with your friends =)

more useful tips will be shared here.

Hi Kai, I heard that we will get banned if we constantly withdraw money out of bigpay. Is that true?

Hi Yik,

Where you heard that info? I doubt it is true.

How would they determine “constantly”? Different people have different needs.

They should remove this feature if they don’t want people to do so. Otherwise, I think it is unfair that they simply ban people due t this reason

Hi Kai, what can we do with/ what is the benefit of Maybank 2 Visa/Master Card?

Also, what is your thought on Citi Simplicity+ Card?

Hi Raymond,

Maybank 2 cards’ AMEX card – 5% cash back on weekend spending and 5 treatspoints for every RM1 spent.

Maybank 2 cards’ Visa/Master – 1 treatspoints for every RM1 spent. Basically, you only use it when the merchant does not accept AMEX card. But if you read my whole post thoroughly, you may utilize the other 4 cards mentioned above to get more cash back.

Hi Kai, I saw in Ringgit plus site that MBB Amex card is only entitled for 5%cashback on only retails spends on weekends..but in ur post you mentioned all types of transactions?

Yes, “retail” in this case actually means any kind of commercial transaction.

Hi Kai, your page is very informative. I immediately applied for Maybank Barcelona card 🙂

Do you have any idea on which cards are good for travels booking, ie, air tickets / hotel bookings?

Hi Kar Mun,

If you’re booking flights with AirAsia, you can always use BigPay because there is no charge of credit card processing fee for BigPay

hi, Maybank 2 cards AMEX and MasterCard are not entitle for cashback when top up to bigpay card?

Good day, Jordan

Wanna make 2 statements clear here:

1. BigPay doesn’t accept top up/reload from AMEX at the moment.

2. MBB2 Card Mastercard won’t give you any cash back. Only Amex does.

Thank you. Hope it helps.

Hi Kai, thanks for your explanations.

Hi Kai, let say I have a big amount to clear every month. Do you recommend to focus on AMEX (to collect the 5x treat points after the cash back limit hit) or switch the rest to SC JOP?

Hi Richard,

I recommend you switch to SC JOP for the rest of your spending.

Reasons being:

1. According to current online treatspoints catalog, it takes 57,500 points to redeem Aeon RM100 voucher. It is equivalent to 575 points to RM1.

You need to spend RM115 to earn 575 points. It translates to RM1 cash back with spending of RM115, you only get 0.8% cash rebate.

2. There is a limit of 5x treatspoints for petrol expenses, which is only up to RM500. Afterwards will be only 1x treatspoint per ringgit spent. Beware!

3. Treatspoints has a limited validity period. Although it is very long, if you don’t redeem it while it is valid, you will lose it. Redemption is another extra step or effort to do so.

So, why not just make your life easier by using another credit card with higher cash rebate rate and easier rebate mechanism. Cheers~

hello…its me again..haha

just curious on JOP card..does a $2500 topup to bigpay using JOP card straight away entitle for the $85 cashback?

yo bro, Yes!

If you feel this site or my post is beneficial, care to share some kind words with your friend on facebook/twitter or word of mouth?

Wanna get more exposure hahaha. *shameless promotion*

Hi Kai & Azam..sorry to disturb your conversation..

just want to ask..if topup bigpay using JOP card..it will under auto payment,online purchases & petro or other categories?

Thanks!

Hi Afd,

Not a problem. Everyone free to leave comments here.

It is considered as online purchases.

An additional note for you, you will need to redeem the cashback through 360 rewards at Standard Chartered official website.

https://360rewards.standardchartered.com

If you interested to apply for any of those cards, kindly apply through the links in my post to support this website.

That’s the way you help me to keep this site clean from advertisement and fast for optimum user experience.

HI Kai,

what about using FC Liverpool credit card to top up Boost e wallet, would that entitle me to get the cashback under shopping category?

Hi Santhi,

I have not tried to top up to Boost directly yet.

But I can confirm that FC Liverpool credit card top up to BigPay entitles cashback.

You can then use BigPay to top up to Boost whenever you want.

At this moment, I don’t recommend anyone to store too much credit in Boost because it will be a hassle in the event that you need to transfer out the money from Boost.

Many users reported that the transfer to bank process takes very long time – https://support.myboost.com.my/hc/en-us/articles/115002558393-Can-I-transfer-out-money-from-my-Boost-Wallet-to-my-bank-account-?page=2#comments